The Market For Handheld Bar Code Scanning

This white paper presents certain top-level findings from  the handheld bar code scanner volumes of VDC's 2007 Automatic Identification/Data Collection (AIDC) Global Industry Business Planning Service. This research service covers major AIDC industry forces and trends, including product and technology development, competitive analysis, distribution analysis and end-user consumption analysis. The report provides clear and objective shipment forecasts for AIDC hardware and bar code printer consumables along with actionable recommendations applicable to today's participants and tomorrow's leaders.

the handheld bar code scanner volumes of VDC's 2007 Automatic Identification/Data Collection (AIDC) Global Industry Business Planning Service. This research service covers major AIDC industry forces and trends, including product and technology development, competitive analysis, distribution analysis and end-user consumption analysis. The report provides clear and objective shipment forecasts for AIDC hardware and bar code printer consumables along with actionable recommendations applicable to today's participants and tomorrow's leaders.

VDC segments the handheld bar code scanner market into four technical segments:

- Laser scanners;

- Linear imagers;

- 2D imagers; and

- Pen/wand scanners.

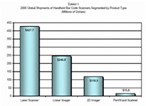

In 2006, the global market for handheld bar code scanners approached $810M dollars (see Exhibit 1). VDC anticipates handheld scanners to grow at a compound annual growth rate (CAGR) of 8%, nearing revenues of $1.18 billion by 2011. Growth for imagers is expected to outpace that of laser scanners due to declining price points and enhanced performance capabilities.

Primary issues, forces, and trends influencing the current and future global handheld bar code scanner market include:

- As of July 1, 2006, RoHS and WEEE went into effect, causing suppliers of electronics equipment to eliminate lead, cadmium, mercury, hexavalent chromium, and polybrominated diphenyl ethers from all new products shipped to the European region. Compliance required a significant amount of resources for most vendors and several were unable to comply by the deadline, limiting their 2006 sales to the region;

- Customer requirements are changing as AIDC hardware products become more integrated into mobile solutions. For example, end-user adoption of wireless technologies such as 802.11 and Bluetooth are driving demand for increased ruggedness, longer battery life, and compatibility with multiple wireless protocols;

- Although growth of the laser scanners has diminished over the past few years and continues to lose share to imaging technologies, particularly 2D, it is still exhibiting growth rates (CAGR) in excess of 9% for more rugged environments such as manufacturing, field sales/service and health care; and

- Manufacturing continues to shift toward emerging nations as a mechanism to stay price competitive and maintain margins. A significant portion of sales within these emerging manufacturing centers is conducted via domestic channels. In order to create a more prominent domestic presence, handheld scanner vendors are aggressively establishing local distribution channels and programs.

HANDHELD BAR CODE SCANNERS – ECONOMIC SECTORS

The majority of 2006 handheld bar code scanner revenue shipments were concentrated in the transportation/logistics and retail economic sectors, with nearly 60% of the global revenue shipments to these two markets (see Exhibit 2). VDC anticipates strongest growth in the health care services and government sectors due to the increasing need for mobility and compliance with current and emerging standards.

SOURCE: Venture Development Corporation